Graphic supply: Getty Photos

If you are not making use of the dwelling office environment deduction, you could be having to pay additional in taxes than you have to have to. The Ascent guides you by means of how to use this deduction.

The COVID-19 pandemic brought on an avalanche of individuals working from house for the to start with time. We’ve composed about the challenges and possibilities made by that shift a lot in this article at The Ascent. Writers have talked about: applications for functioning remotely, perform from house hacks, and distraction proofing tactics.

All fascinating things. Now, it is time to place on our gloves, get the shovel, and dig into everyone’s most loved topic: tax generate-offs.

We’ll go above the house place of work deduction and discuss about who can use it, how to use it, and how substantially cash you may preserve.

Overview: What is a residence workplace deduction?

If you have a enterprise and operate out of an place of work or retail building you hire or possess, you can claim various deductions to taxable revenue. You would right deduct lease or curiosity paid out on credit card debt, utilities, depreciation, insurance policy, and repairs and servicing.

The property business office deduction permits you to take all those exact deductions on your tax return if you have a house-based business.

Who qualifies for the residence workplace deduction?

Modest organization owners and impartial contractors with a house organization can use the house place of work deduction to publish charges off of their tiny small business taxes.

Listed here are the vital products to hold in intellect if you are thinking about employing the property office deduction:

- IRS residence place of work policies dictate that the residence have to be the principal place of company. You can do company in other places, but most of it have to be carried out at household.

- When deducting residence place of work costs, you can use the part of your household only that is employed for the small business and, this just cannot be stressed ample, you cannot use that spot for anything else. The finest approach is to established apart a space to use as an office and preserve the door closed when you are not doing the job. If you have young children, put a indication on the door that suggests, “Monsters: Continue to keep out!”

Simplified deduction vs. standard expenditure deduction: Which process is greatest?

If you have any encounter with the IRS, you are in all probability currently leaning towards the simplified system. The IRS definition of normal, primarily when it pertains to small business taxes, typically suggests anything like 20+ webpages of paperwork, months of problems, pledging of your first born, and threats of voodoo magic.

I propose calculating your deduction both equally ways and then deciding upon whichever method lets you deduct a lot more. Let’s choose a glimpse at how to compute every.

Simplified technique

The simplified method is just that, uncomplicated. Work out the full sq. footage that you use for small business, up to a utmost of 300 sq. ft, and multiply that by $5. That is it. I do not even have to generate a graphic on how to do it.

The very best way to determine how several square toes you use is to dig out the appraisal that the financial institution purchased when you purchased your household. It need to have a breakout of the whole square footage of the house and the sizing of every single area. We’ll use the overall sq. footage for the subsequent technique.

Typical process

To use the typical method, work out the whole qualified expenses for your property and then establish the part of individuals that are utilised for the company. If you have a 2,000-sq.-foot property and use a 400-sq.-foot home for the small business, you would consider (400 ÷ 2,000) 20% of the deductible expenditures.

Use IRS variety 8829 to compute the full deductible costs for your household office environment tax. This variety really should be available and quick to determine out on your tax computer software.

How to ascertain your property business deduction

Sarah’s Sanguine Salamanders has experienced a rough go of it. Not numerous folks imagine of salamanders as good psychological assist animals. So, Sarah is continue to operating out of the basement in her property. Her enterprise is a solitary-member LLC, and she is prepared to post 2019 taxes. Let us get a look at which method she should really use.

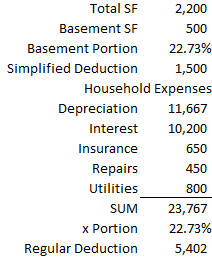

Sarah should clearly pick the regular deduction which is just about three moments the simplified. Image source: Writer

Sarah utilizes additional than the max permitted 300 square ft for her business office, so she would just take the optimum allowable simplified deduction of 300 x $5 = $1,500.

Now think about how a great deal she could deduct applying the common method. Sarah’s residence bills are quite normal for a dwelling valued at all over $350,000.

Depreciation is calculated utilizing the straight line strategy, and the yearly curiosity was estimated primarily based on an first bank loan amount of money of $300,000. If you’re going to use the normal process, maintain data (ideally receipts) of your insurance policies, repairs, and utilities charges for six years soon after you file taxes.

Just about every of those people bills is itemized in the graphic over. Sarah’s household has a complete square footage of 2,200, and she makes use of 500 sq. ft for her small business. This is equal to 22.73% of the total property, so she would be ready to cost 22.73% of residence expenditures.

Until you are filing independent contractor taxes for a aspect hustle and use much less than 300 sq. ft of your household, the common method will virtually generally enable you to deduct much more than the simplified process.

There is also the dilemma of the time it usually takes. If the common strategy will most likely only allow a few hundred dollars more to be deducted, and you really don’t track household fees religiously, emphasis on hoping to obtain tax credits alternatively of calculating depreciation.

What if you might be working from residence for just a couple of months?

If you are self-utilized, due to the fact you very own your small business or as an independent contractor who gets a 1099 each yr, use a single of the procedures we talked about higher than to acquire the household business deduction for the time that you applied your dwelling as your principal place of business enterprise.

Sadly, if you are a W-2 worker operating from property for the reason that of COVID-19, you are ineligible to use the deduction (unless of course you have a aspect hustle the place you get a 1099).

House is in which the taxes aren’t

That is clearly wishful considering, but the dwelling business office tax deduction does allow you to lower the tax stress on your organization and make it a minor extra well worth it to do the job from residence through a pandemic — as very long as you established rigorous boundaries for that location.

If you have a aspect hustle and have been functioning for 1099 payments, think about dedicating a place just for that function. My wife’s facet hustle only took about 25 several hours of work every thirty day period to total, but we ended up in a position to designate a space as her business office and substantially decrease the tax load of the side job.